Search Results

Products

FAQs

Is the CUofCO Cards App Secure?

The CUofCO Cards App can only be accessed from your mobile phone using your username, password or fingerprint.

Who does the CUofCO partner with for investments?

LPL Financial

Why am I getting a 1099 from CUofCO?

As a new member of the Credit Union of Colorado, you have received or will receive a 1099-INT tax document from us in the mail, which shows the interest you have earned in the past year plus $15.

When you joined the credit union, we deposited $5 into a membership account and donated $10 to the Credit Union of Colorado Foundation on your behalf. Officially, this resulted in a total of $15 of reportable income. According to IRS regulations, we must include this amount in the “interest earned” box of the 1099-INT form.*

The $10 contribution to the Credit Union of Colorado Foundation is an eligible charitable donation you may be able to deduct from your 2022 income taxes. Please consult with an appropriate tax professional.**

*Full IRS requirements can be found here: https://www.irs.gov/instructions/i1099int

**CUofCO does not provide tax, legal, or investment advice. This message does not represent tax, or legal advice, and you should always consult your tax or legal advisor with questions regarding tax issues.

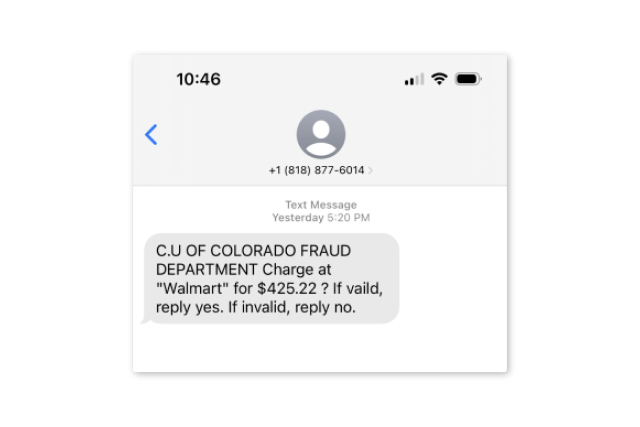

I received a suspicious smishing text or phishing email posing as CUofCO.

We have received many calls from customers who have given their online banking and personal information in replies to texting and phishing scams. If the links are not @cuofco.org, it is someone trying to steal your information. Do not reply to such a text, simply block the number.

Skip a Payment Disclosure

*By participating in the Credit Union of Colorado (CUofCO) skip-a-payment offer, you are requesting to skip your loan payments as indicated above. You agree and understand that: 1.) You must specify whether your loan is paid with an ACH or payroll deduction in order for CUofCO to stop payment. If CUofCO is unable to stop your ACH or payroll deduction payment in time, your skip-a-payment may be delayed until the next scheduled payment; 2.) You must specify whether your loan is paid by auto-deduct through online banking or another method from any banking institution (including CUofCO). CUofCO is unable to stop payments set up though these methods. Any payment(s) that are approved for skip-a-payment but automatically made through an automatic payment method will be re-directed as a deposit into your share account; 3.) Skipping your payment(s) may result in your having to pay a higher total finance charge than if you made your payment(s) as originally scheduled. Interest will continue to accrue on the outstanding principal balance during the payment deferral period; 4.) The skip-a-payment may extend the maturity date and payment terms for each of your loan(s) on which one or more payments are skipped, and you have to make more payments to extinguish the balance of your loan(s) than was originally specified in your loan documents. In the event your skip-a-payment request is granted, you agree to fully cooperate with CUofCO to sign any and all documents requested by CUofCO to: a. Document the skip-a-payment and loan modification; b. Preserve any and all CUofCO security interest and rights indicated on the initial loan documents; 5.) If you elected to add GAP or Warranty Coverage to your loan(s), the coverage may not extend beyond the original maturity date; 6.) You are required to resume your payments when the skip-a-payment period is over; 7.) If your loan is delinquent, regular credit reporting will continue 8.) You must have made six (6) consecutive monthly payments to your CUofCO loan(s) to be eligible for a skip-a-payment; 9.) You cannot skip-a-payment on any loan for two (2) consecutive months; 10.) All skip-a-payments are subject to Credit Union approval; 11.) Maximum of two (2) skip-a-payments are allowed per year, one (1) via Self-Service and maximum of six (6) skip-a-payments are allowed during the life of the loan; 12.) Skip-a-payments are not available on Real Estate Loans and Flex Choice Balloon Vehicle Loans. 13.) Skip-a-payments on Home Equity Line’s of Credit must be approved by the Credit Union of Colorado.

Can I access or close a loved one’s account after death?

For more information, refer to our guide on managing your loved one's financial accounts at https://www.cuofco.org/loss-loved-one.