Where do I sign my new vertical contactless card?

Unlike some other cards issued by Visa, our advanced technology has rendered the need for a signature obsolete. Therefore, please refrain from signing your card.

Unlike some other cards issued by Visa, our advanced technology has rendered the need for a signature obsolete. Therefore, please refrain from signing your card.

Bank jugging refers to a criminal act wherein perpetrators observe individuals withdrawing money from their bank or credit union and subsequently follow them to steal the cash. The term "jugging" originates from the notion of a jug, typically used to carry large amounts of money. This is a crime that is on the rise this summer across the country.

While jugging can occur in various scenarios, such as ATM withdrawals or cash transactions, credit union members should remain vigilant to mitigate the risk of becoming a victim.

Safety Measures to Avoid Jugging:

While jugging poses a threat to individuals conducting financial transactions, adhering to these safety measures can significantly reduce the risk of falling victim to this crime. By maintaining awareness, adopting precautionary habits, and leveraging the security resources available to you, you can enhance your safety as a credit union member and protect your hard-earned money.

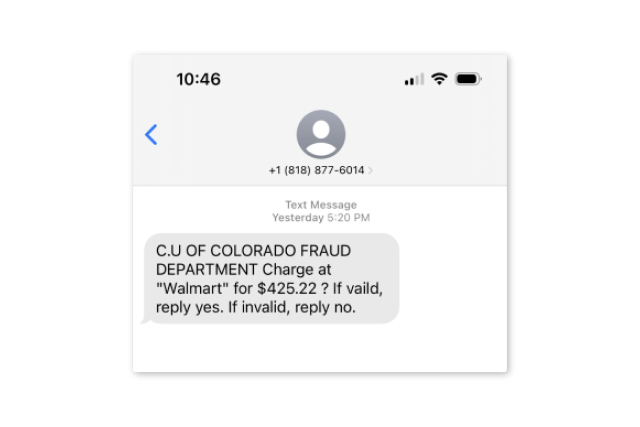

We have received many calls from customers who have given their online banking and personal information in replies to texting and phishing scams. If the links are not @cuofco.org, it is someone trying to steal your information. Do not reply to such a text, simply block the number.

Digital wallets are generally considered safe for payments, and they offer several security features to protect consumers' financial information.

To schedule recurring payments to a first mortgage loan using an external account, please complete the following steps.

Go to Accounts Tab, and click the first mortgage account to be routed to the mortgage servicing portal. If needed, agree to allow pop-ups for this window to appear.

Click on the three lines in the top right corner and click "Payment Options" under the Payments dropdown.

Select "Set up Auto Pay/Recurring Draft," and then click, "Continue."

Read through the Authorization for Recurring Payments and click, "Approve."

Enter the account type, routing number, account number, and the amount to pay. Click "Next" to confirm.

Review and click "Submit."

To schedule a one-time-payment for a first mortgage loan from an external account, member advocates are available through the chat feature on our website (click the green bubble on lower right corner of your screen) or by calling 1-800-444-4816 during normal business hours.

To schedule recurring payments to a first mortgage loan using an external account, please complete the following steps.

Go to Accounts Tab, and click the first mortgage account to be routed to the mortgage servicing portal. If needed, agree to allow pop-ups for this window to appear.

Our Special Reserve Loan is a line of credit that is linked to your checking account and prevents your account from going negative up to a specific credit limit.

Courtesy Pay allows certain accountholders in “good standing” the ability to overdraw their personal checking accounts up to a predetermined limit. There is a $25 fee per paid item.

Please click here or call us at 800-444-4816 to order checks.

You can only cancel a payment if the person you sent money to hasn't yet enrolled with Zelle®.